The new age of live-biotherapeutics is the topic of conversation when Dr Gary Waanders, Healthcare Research Director at Zeus Capital talks to DirectorsTalk. Gary explains what is driving the interest in this field, the key themes for how the Live Biotherapeutics Products will work and which companies should we be keeping an eye on.

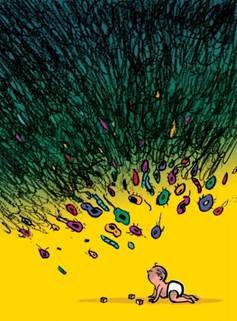

The awareness of the microbiome and its relationship to human health and disease has grown in recent years and now attracts much interest from the global pharmaceutical and biotechnology industry. The human microbiome is comprised of over 100 trillion microbes which live in a number of different niches on or in the body, but mostly in the gut. The realisation that these microbes are more than mere ‘passengers’ has come about as alterations in the numeric and functional diversity of the microbial community have been characterised in far greater detail than ever before. Driven by technology innovations the growing depth of microbiome knowledge has enabled the dissection of associations between specific microbial communities and certain disease states. In this context, the potential to exploit the microbiome to treat or prevent the development of diseases is now being more fully explored by scientists and clinicians in both academia and industry. Strategies to therapeutically exploit the gut microbiome include standard small-molecule drug approaches, selective dietary supplements and bacteria themselves as therapeutic agents, so called live biotherapeutic products.

Global interest in the microbiome – the microbiome has been the subject of intense interest by both academia and the pharmaceutical industry in recent years. This is evidenced by the rapidly growing number of scientific publications in the field from 247 papers in 2005 to over 5,000 papers in 2015, and almost 400 clinical studies in the USA. Further recognition of the clinical potential of the field has come in the form of government sponsored initiatives such as the Human Microbiome Project launched in 2008 for which the US National Institutes of Health (NIH) invested $115m in 2012. This NIH backing raised the institutional and scientific credibility of the field and triggered greater academic and industry efforts to recruit the best scientific talent and technology development. Significant licensing and co-development deals have followed to secure access and rights to the technologies and products of innovators and developers.

Global interest in the microbiome – the microbiome has been the subject of intense interest by both academia and the pharmaceutical industry in recent years. This is evidenced by the rapidly growing number of scientific publications in the field from 247 papers in 2005 to over 5,000 papers in 2015, and almost 400 clinical studies in the USA. Further recognition of the clinical potential of the field has come in the form of government sponsored initiatives such as the Human Microbiome Project launched in 2008 for which the US National Institutes of Health (NIH) invested $115m in 2012. This NIH backing raised the institutional and scientific credibility of the field and triggered greater academic and industry efforts to recruit the best scientific talent and technology development. Significant licensing and co-development deals have followed to secure access and rights to the technologies and products of innovators and developers.

Commercial opportunities – the microbiome could have an impact on diverse diseases ranging from local conditions of the gut (e.g. Crohn’s disease, ulcerative colitis) to systemic diseases including autoimmune and neurological disorders (e.g. multiple sclerosis, Parkinson’s disease), cancer and respiratory ailments (e.g. asthma, COPD). These therapeutic areas are highly valued as pharmaceutical markets with many products reaching blockbuster sales levels. Targeting the functions of the gut microbiome represents a new strategy for therapeutic intervention and drug development. Indeed, efforts to develop microbiome-targeted drugs include everything from dietary factors and drugs to enhance or limit certain microbial activity to administering specific live bacteria themselves as the active therapeutic agents (live biotherapeutic products or LBPs). LBPs are attractive as product candidates because their derivation from commensal bacteria enables a shortening of development timelines as health regulators believe they are safe.

Also in this report:

4D Pharma Plc (LON:DDDD)

Assembly Biosciences Inc (NASDAQ:ASMB)

Evelo Biosciences

Oxthera.AB

Seres Therapeutics Inc (NASDAQ:MCRB)

Synlogic

Vedanta Biosciences

You can download the full report that Dr Waanders published here.