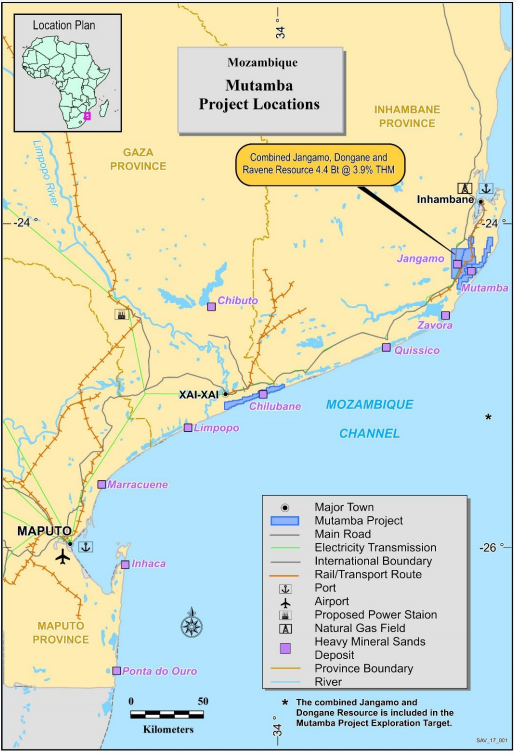

Savannah Resources plc (LON:SAV), the AIM quoted resource development company, has today announced that phase one of the pre-feasibility study (‘PFS’) into the potential development of the Mutamba Mineral Sands Project, Mozambique (Figure 1) has now commenced. To view the press release with the illustrative maps and diagrams please use the following link: Savannah.pdf

HIGHLIGHTS:

· Stage one of the Mutamba PFS is now underway, which will include a gap analysis, options review, project planning and budget finalisation for stage two of the PFS

· Mineral sands expert TZMI has been appointed to complete this phase of the work

· It is anticipated that this work will be finalised in coming months

· The completion of the PFS is a key Consortium milestone and will result in Savannah earning a 35% interest in the Mutamba Consortium

Savannah Resources Plc CEO, David Archer said: “We’re pleased that the first stage of the Mutamba PFS has been contracted to TZMI. Having completed the Scoping Study for us, TZMI is well placed to undertake the work and deliver a quick outcome. The conclusion of the PFS is an important strategic milestone, as on delivery of the completed document Savannah will have earnt a 35% interest in the Mutamba Heavy Mineral Sands project, which is one of the largest undeveloped mineral sands deposits in the world.

“At the same time, the assembly of the 20tph pilot plant is well underway. This will provide product for metallurgical and product test work by our partner, Rio Tinto. The Consortium Agreement includes an offtake agreement on commercial terms for the sale of 100% of heavy mineral concentrate production to Rio Tinto (or an affiliate).”

Figure 1. Mutamba Project Location Map

Stage One Pre-Feasibility Study (Definition and Scoping Stage)

Stage One of the PFS will involve the delivery of the following key deliverables:

Gap Analysis: Detailed review and gap analysis to firm up on the scope for the PFS in alignment with the Consortium’s development objectives.

Options Review: Undertake a high-level review of various project development alternatives (e.g. project scale, product alternatives, location of processing plants, transport routes, mining method, infrastructure, etc.) and agree on which options will be evaluated in the PFS.

Project Planning: Development of the PFS work programme and identification of the project team for the completion of the PFS. Proposals will be sought for key programmes of work and used to refine the schedule and a cost estimate.

It is anticipated that this work will be finished in coming months.

About TZMI

TZMI has a long history of assisting and providing services to international mining companies, investment banks and financiers, private equity firms and a large number of listed companies who have investigated opportunities in the titanium and zirconium industries. Its services have been in the form of independent expert reports, technical and economic evaluations, technical process engineering, scoping and pre-feasibility studies, benchmark audits and cost reviews, strategic analysis, supply/demand analyses and forecasts for TiO2 feedstock and zircon markets and operations around the world. TZMI’s expertise and knowledge has been developed over many years from the direct involvement of its principals and consultants in chief executive, senior operational, technical, analytical and marketing roles, together with significant consulting experience to various international corporations for major project studies.